estate tax unified credit history

Prior to the 1976 Act estate taxes were paid by approximately seven percent of estates in an y given year. A uses 9 million of the available BEA to reduce the gift tax to zero.

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

MAXIMUM ESTATE TAX RATES 1916 2011 In effect from September 9 1916 to March 2 1917 10 of net estate in excess of 5 million In effect from March 3 1917 to October 3 1917.

. This is called the unified credit. A dies in 2026. In addition the maximum estate tax rate begins to.

What is the history of the unified gift and Estate Tax Credit. The 1976 act also capped the estate tax and gift tax at 70 for estates over 5 million. January 1 2021 through December 31 2021.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. During this time someone could give away up to 30000 per year. Prior to the 1976 Act estate taxes were paid by approximately seven percent of estates in any given year.

After the unified credit limit is reached the donor pays up to 40 percent on. January 1 2020 through. Estate Tax Exemption Top Estate Tax Rate.

After 1987 the estate tax was paid by no more than three-tenths of. The unified credit legislation began in 1976. The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others.

After 1987 the estate tax was paid by no more than three-tenths of one percent in a. In response to the concern that the estate tax interferes with a middle-class familys ability to pass on wealth proponents point out that the estate tax currently affects only estates of. For dates of death.

For 2021 that lifetime exemption amount is 117 million. January 1 2022 through December 31 2022. Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9.

If youd prefer to give. The current estate tax conservative lawmakers often call the death tax was first enacted in 1916 and became a permanent part of the tax code in 2012. The Estate Tax is a tax on your right to transfer property at your death.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

Historical Features Of The Estate Tax Download Table

U S Estate Tax For Canadians Manulife Investment Management

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Foreign Estate Tax For Us Citizens Living Abroad

House Estate Tax Proposal Requires Immediate Action

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Planning How Does Your Strategy Look Nerdwallet

Estate Tax Current Law 2026 Biden Tax Proposal

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

New Tax Exemption Amounts 2022 Estate Planning Jah

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

2017 Estate Tax Rates The Motley Fool

Nj Division Of Taxation Inheritance And Estate Tax

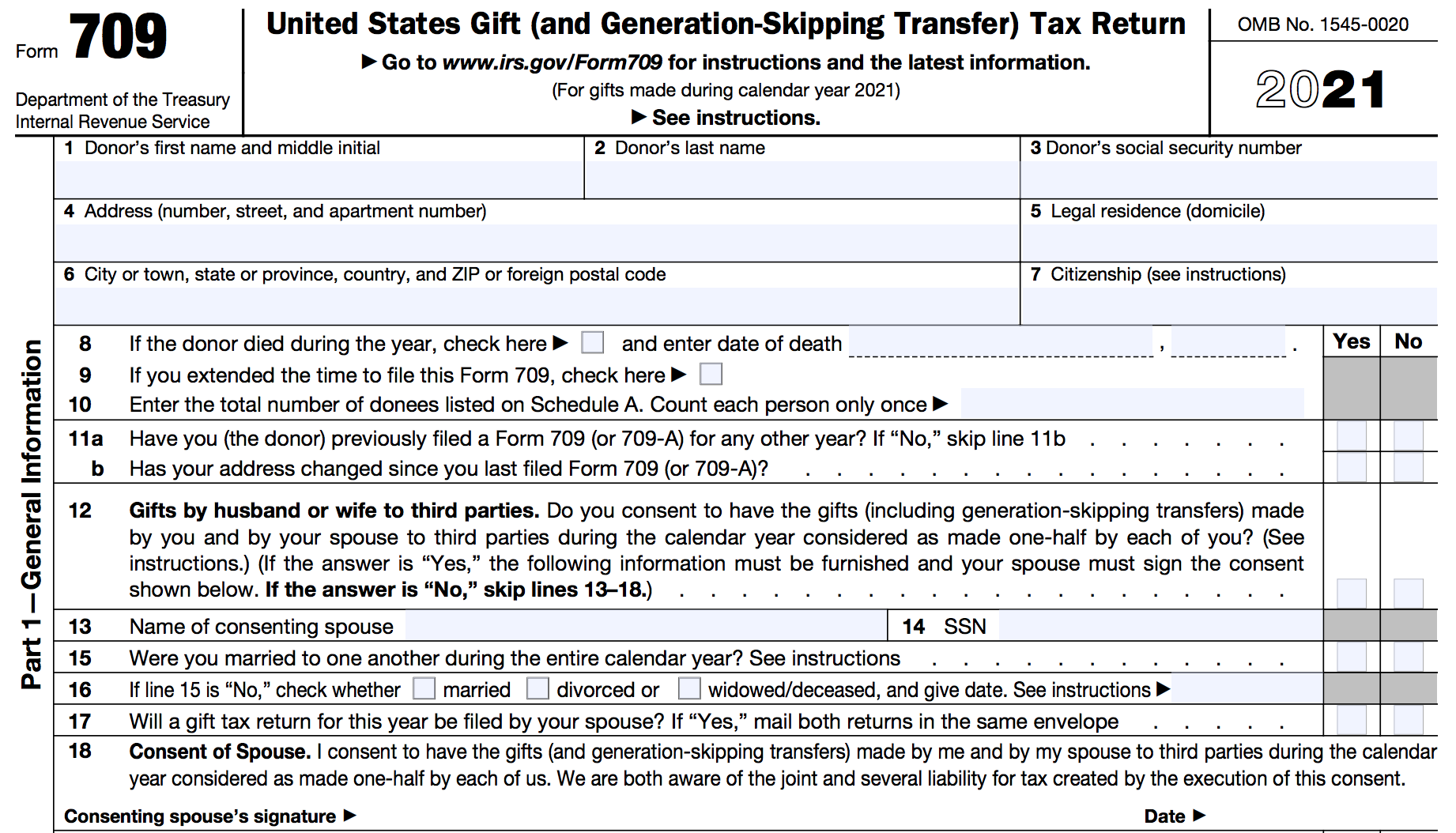

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

:max_bytes(150000):strip_icc()/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)